Car Sales Graph in Malaysia During Gst and Non Gst

That means the total impact would be 4-7 more compared to those who get before end of this month. Behaviour on the implementation of GST and its effects on their spending during holiday the results obtained can help narrow the gap of knowledge in this field.

The current tax rate for sales tax is 5 and 10 while the service tax rate is 6.

. Both the Malaysia GST and Singapore GST are broadly. Vehicles other than those mentioned above. Analysts are optimistic on sales of cars as total industry volume TIV in July 2018 accelerated to 68000 units its second highest monthly volume in the history of Malaysia.

Daniel Fernandez Jun 13 2022. 2015 that the GST. GST Margin Scheme for Second Hand Car Dealer in Malaysia.

15-04-2020 GST Impact on sale of used car Page 28 notification would be valid till 30th June 2020. The lowest GST rate on vehicles of 5 applies to carriages for use by disabled people and related accessories. On September 1st 2018 the Sales and Services Tax SST was reintroduced to replace the unpopular Goods and Services Tax GST.

It was stated by Sanusi et al. Inland Revenue Board of Malaysia. For advice on SST do not hesitate to contact Acclime.

Sales Tax Rate in Malaysia remained unchanged at 10 percent in 2021 from 10 percent in 2020. The introduction of the six percent GST in Malaysia from April 1 2015 will bring forth radical changes to the Malaysian tax landscape. Sale Purchasing GST on margin or 2.

However GST is not the only tax applicable to motor vehicle sales as a compensation cess of up to 22. Loh Boon How Chartered Accountant. Petrol and parking expenses of a motor car is not claimable.

Selling car prices in Malaysia will be moving upwards because of the GST and more. 12018 under the GST Compensation Cess Act. Businesses can usually recover the GST charged on their acquisition as their input tax credit.

If GST is going to raise it 1-3. The standard goods and services tax GST in Malaysia is sales and service tax SST of 10. The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and accounting business consulting electricity.

The countrys 6 goods-and-services tax is being abolished and there will be a 2- or 3-month tax holiday before a 10 Sales and Services Tax is reintroduced. But there were signs of recovery in 2021 as the economy grew by 31 per cent. Hence the GST incurred on the purchase and running expenses eg.

Best is get the car during the tax holiday. SUVs and Utility Vehicles. It applies to most goods and services.

Explore yourself and find out today the GST on Margin Scheme for Second Hand Car Dealer. The cost and running expenses of a motor car except for Q-plated cars with COE issued before 1 Apr 1998 are disallowed expenses under Regulation 27 of the GST General Regulations. The two reduced SST rates are 6 and 5.

Sale of second hand cars is exempt from GST Compensation Cess vide Notification No. This cannot be avoided and even though there will be some anger and disappointment coming from the middle class to the lower middle-class segment in Malaysia it must be noted that the real impact of the Goods and Services Tax GST. The GST also known as value added tax VAT in some countries is not a new concept of taxation as other countries in the region introduced GSTVAT years ago.

So Customs will refund the tax on 20 of RM200000 which is RM40000. Sale Purchasing No GST The margin include the repair cost and profit The GST 6106 x selling - purchasing price. After 25th January 2018 GST rate on supply of old used vehicles was same as applicable on supply of new vehicles till 25th January 2018.

The most relevant GST rate on cars is 28 that applies to motor vehicles including those for personal as well as commercial use. However if they obtain most of their stocks from members of the public or non-GST registered persons or from other dealers using the Margin Scheme they will not be able to recover any GST i. SST in Malaysia was introduced to replace GST in 2018.

In 2020 Malaysias economy contracted by 56 per cent due to the pandemic. 10 of that is 4000 compared to the actual sales tax paid which was 10000 said. WHY GST IS BEING CONSIDERED AGAIN.

Under the new SST goods are taxed between 5 to 10 percent and services at 6 percent. The GST rates applicable till 25th January 2018 and thereafter provided below for easy reference. Literature Review GST and Tourism Industry Good and Service Tax GST is a consumption tax imposed on the sale of goods and services.

If your company is already GST-registered the MySST system will automatically register your company for SST.

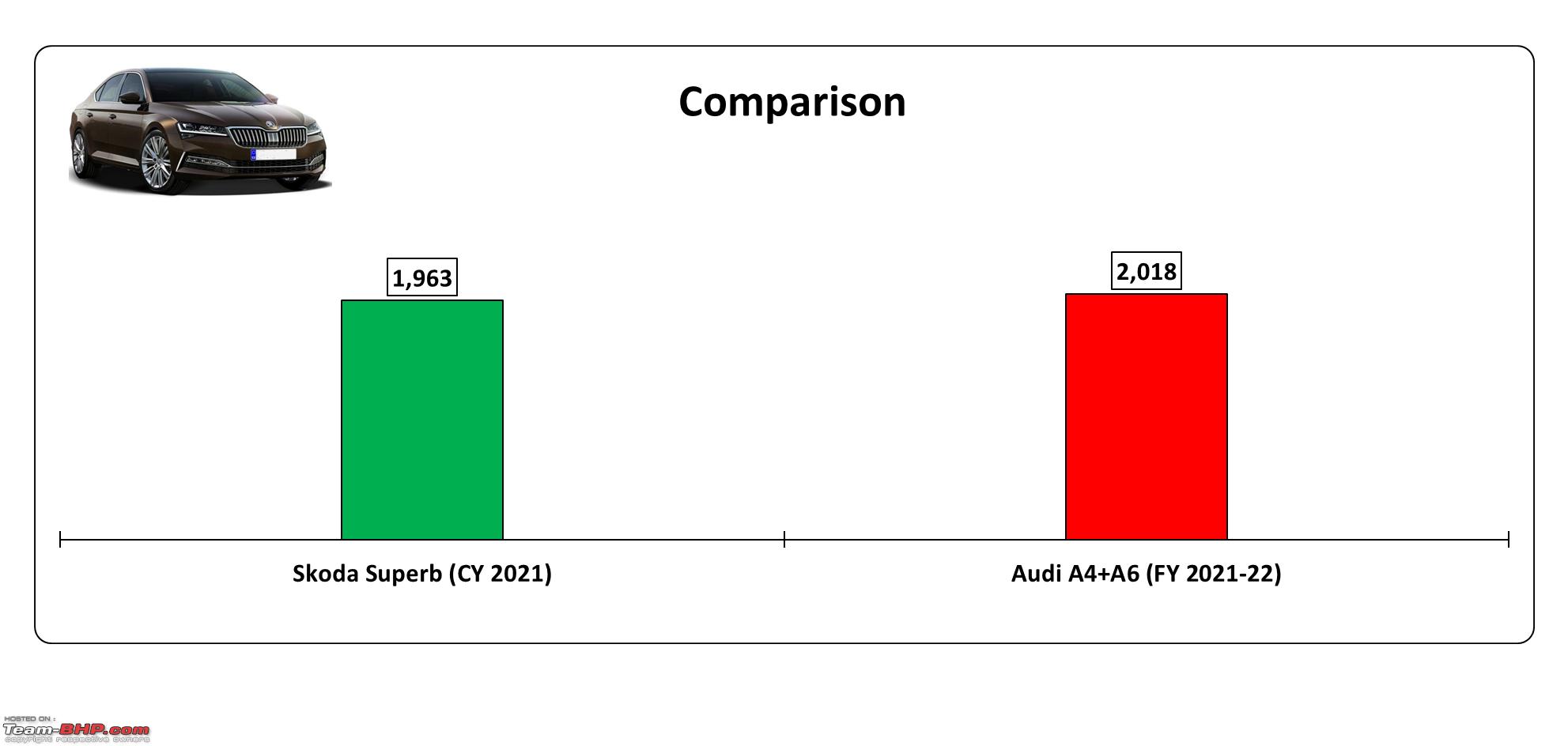

Luxury Car Sales Analysis In India Fy 2021 22 Team Bhp

Steady Rise In Metal Prices Is A Big Risk For The Automotive Industry Business Standard News

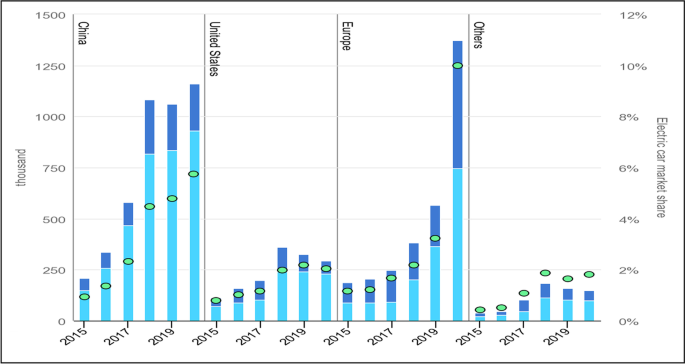

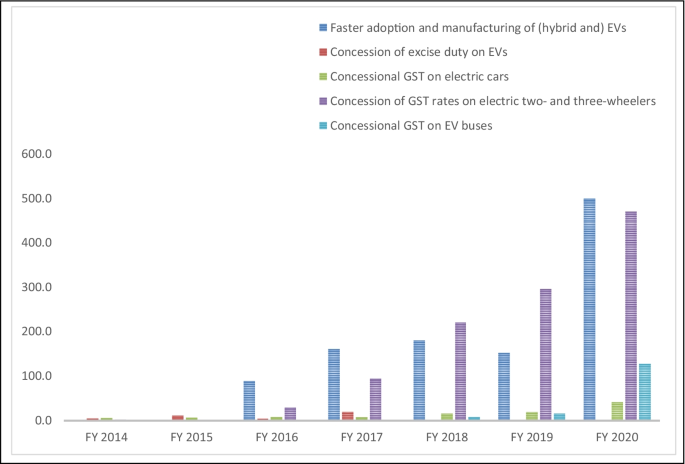

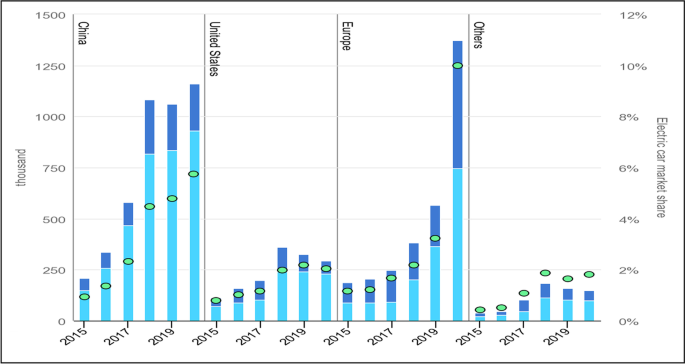

Global Electric Vehicle Adoption Implementation And Policy Implications For India Springerlink

Sales Tax Exemption Some Cars Save You Just Rm 1k Others Over Rm 10k Find Out Which Is Which Wapcar

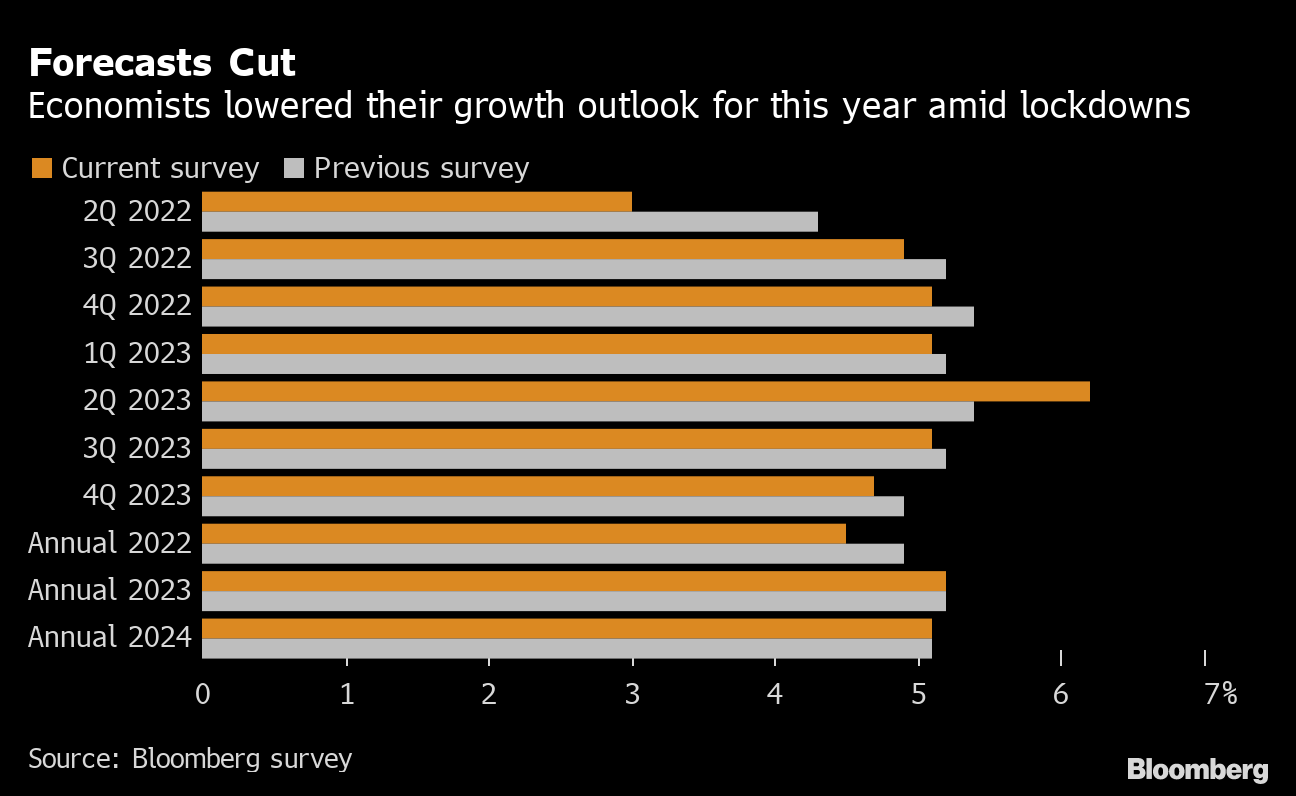

China Unveils Car Tax Cut Details In Bid To Boost Spending Bloomberg

Global Electric Vehicle Adoption Implementation And Policy Implications For India Springerlink

0 Response to "Car Sales Graph in Malaysia During Gst and Non Gst"

Post a Comment